Sunday, December 28, 2008

An Odd Thought

The latest wave of fraud (Madoff) and the first wave of fraud (subprime) have both featured ethnic ties exploited by hucksters. Madoff was a pseudo-mensch who preyed upon the Jewish community. During the subprime debacle lots of of minorities were led into terrible mortgages by Judas goat Mortgage brokers who were their race or spoke their language.

Monday, December 22, 2008

Class Warfare

Dean Baker: More Class Hatred in the Washington Post

Somehow resenting the excess pay of someone who makes 1000 times as much as you is the "politics of envy" while resenting the pay of someone who makes a few percent more than you do is "populism".

The Post editorial, after deploring the fact that bailout money was diverted from Wall Street to the real economy, celebrated the pay cuts that the bailout would impose on UAW workers. For some reason, the Post attaches enormous importance to reducing the pay of auto workers who earn $28 an hour. It shows no comparable concern for reducing the pay of auto industry executives to parity with their foreign competitors. (The top executives at Toyota, Honda, and other successful companies get paid in the neighborhood of $1-2 million a year. Unlike their U.S. counterparts, they don't get paychecks in the tens of millions of dollars even in the best years.) The Post has allso never felt the need to insist on large pay cuts for Wall Street executives even though their banks are now wards of the state.

Somehow resenting the excess pay of someone who makes 1000 times as much as you is the "politics of envy" while resenting the pay of someone who makes a few percent more than you do is "populism".

Monday, December 08, 2008

WMDs on Wheels?

Today's Trucking: Poultry a Road Hazard?

There's a happy thought if the Bird Flu ever goes virulent.

Apparently, it's not diesel exhaust exposure you should worry about when pacing behind another tractor-trailer. Instead, you might want to roll up the windows and hold your breath if you're ever trailing a live chicken hauler.

According to a new study by researchers at Johns Hopkins University, chickens hauled in crates on open flatdecks can release antibiotic-resistant bacteria along the highway and into vehicles traveling behind them.

There's a happy thought if the Bird Flu ever goes virulent.

Friday, November 28, 2008

Pay to Play is alive and well

Daniel Howes, Detroit News: Cashing in on double standards

Howes goes on do detail all the incestuous ties between the twits who brought us the financial crisis and the Democratic powerbrokers. It's a good thing that John McCain did such a bang up job getting corporate money out of Washington.

The feds pump another $20 billion into teetering Citigroup Inc. and insure $306 billion in bad assets just days after Congress slaps Detroit's automakers for failing to table "a plan" to justify $25 billion in loans and folks 'round here cry, "Double standard! Double standard!"

......Double standard? You bet, but it's more than a geographic cabal of coastal Democrats and anti-union, pro-foreign auto Republicans from the South that clearly has it in for Detroit. It's money and political alliances, folks, neither of which the boys at General Motors Corp., Ford Motor Co. and Chrysler LLC have in abundant supply.

How come Citigroup gets a pass and a big fat check? First, failure of its sprawling operations truly would pose a mortal threat to the global financial system. Second, the banking giant is exceedingly well connected to the campaign wallets of the very same folks -- and their allies -- who are poised to foist draconian terms on Detroit to keep it afloat.

Howes goes on do detail all the incestuous ties between the twits who brought us the financial crisis and the Democratic powerbrokers. It's a good thing that John McCain did such a bang up job getting corporate money out of Washington.

Sunday, November 23, 2008

One Question

It sounds like Congress had a great deal of fun hectoring the heads of the automakers and the union. One thing that bothers me though. If the principle holds that people who fail deserve a pay cut then it seems, given the failures in regulation and oversight at the root of this financial disaster, to be pertinent to ask "Where is Congress' pay cut?"

Make no mistake the vast sums of borrowed money from UncleSam Hu being stuffed into the carcasses of the banks this Thanksgiving are intended to save, not the assets of the imprudent Bankers, but the asses of the Congressmen whose sins of omission and commission were the prerequisites to this slow motion disaster.

[Update: Mitch Albom lays down a delightful rebuke of Congress.

Make no mistake the vast sums of borrowed money from Uncle

[Update: Mitch Albom lays down a delightful rebuke of Congress.

Is a man an interchangeable part?

Right now the UAW is trying to present a united front with the management of the Big 3 but under the surface is a bitter mutual dislike. The UAW sees management as being incompetent, overpaid, and quick to blame the union for its own failures. Management for its part is very bitter about the above market wages and benefits that the unions are able to extract for "unskilled labor" and union workers "inflexibility".

Building a car with competitive efficiency is a highly complex process involving careful design of both the car and the production process. Henry Ford and Walter Chrysler both had the ability to build a car from the ground up with their own hands. Such skills are rare, though, and both turned to masses of semi-skilled laborers, used in very carefully engineered ways, to build their cars. One of the essential points of such an arrangement is that employees are expected to be like the parts they assemble: interchangeable. The process is developed with the intention that any capable person could be placed in any position on the line and keep up. There are some more skilled positions (usually in maintenance and setup) that require more education and pay a little more but the principle holds.

Is it any wonder that people trained to think that a person is an interchangeable part would find the idea of a few people making a huge multiple of what everyone else makes absurd? Management would take the other side and argue that paying a worker nearly double what another worker off of the street would cost* is absurd.

For my wooden nickel, the workers have the better side of it. But then again this is a world where a great inner city school teacher makes far less than a mediocre backup quarterback in the NFL.

*The difference in cost is not so much the wages and benefits being paid to the person on the line, but in pensions and benefits being to retirees that are part of the contract with workers.

Building a car with competitive efficiency is a highly complex process involving careful design of both the car and the production process. Henry Ford and Walter Chrysler both had the ability to build a car from the ground up with their own hands. Such skills are rare, though, and both turned to masses of semi-skilled laborers, used in very carefully engineered ways, to build their cars. One of the essential points of such an arrangement is that employees are expected to be like the parts they assemble: interchangeable. The process is developed with the intention that any capable person could be placed in any position on the line and keep up. There are some more skilled positions (usually in maintenance and setup) that require more education and pay a little more but the principle holds.

Is it any wonder that people trained to think that a person is an interchangeable part would find the idea of a few people making a huge multiple of what everyone else makes absurd? Management would take the other side and argue that paying a worker nearly double what another worker off of the street would cost* is absurd.

For my wooden nickel, the workers have the better side of it. But then again this is a world where a great inner city school teacher makes far less than a mediocre backup quarterback in the NFL.

*The difference in cost is not so much the wages and benefits being paid to the person on the line, but in pensions and benefits being to retirees that are part of the contract with workers.

Monday, November 17, 2008

A Little Naughty Fun

John Emerson explains the economic crisis.

An appetizer:

An appetizer:

Tranches are bundles of loans mysteriously sorted and packaged according to how risky they are. Large corporations buy tranches and use them as collateral to borrow money from other large corporations. These corporations are owned partly by individuals, but mostly by still other large corporations, which themselves might very well also be owned by more large corporations yet. In the end you have millions of actual home loans at one end and millions of actual individual investors at the other, with an undecipherable maze of legal entities and financial instruments linking them. (You might as well discuss quantum theory, it’s easier). Few or none of the flesh and blood owners have any idea what’s going on, until finally one day they wake up and BOOM! their money is all gone. (If anyone knows what happened, it’s probably the managers hired to manage these various legal entities, but they have just voted themselves enormous bonuses and never have cared to socialize or communicate with the pitiful rabble who own the stock anyway.)

Economists don’t worry about these things, though. (Nader does, but Nader isn’t an economist and he’s crazy too.) Economists worry about welfare Cadillacs, transfer payments, and waste in Democratic budgets. Government, in sharp contrast to the free market, is inefficient and corrupt and can never do anything right.

Saturday, November 08, 2008

So long and thanks for all the votes

Chicago Tribune: Obama's team on economy reflects times

I'm sure Obama will be "interested" in the Rust Belt again in time for the next election.

In Chicago on Friday, President-elect Barack Obama will meet with his economic transition team. It's a group that looks a lot like America, or an America that wears very well-tailored suits, anyway.

Often, the "looks like America" phrase, which originated with the Clinton administration, is shorthand for saying the assembled members are not all white men. But the typical measures of diversity—race and gender—are not the principal distinctions in this case.

The America in this group of 17 high-powered advisers is the America of our troubled economy. Wall Street is represented, and so is Detroit. There's a dot-commer, an old-media guy, a real estate investor and some politicians.

....Perhaps the most interesting part of the grouping is the notable swath of the economy that is, in many respects, left out: industrial America and organized labor.

....The lack of labor presence might raise questions about whether Obama truly is committed to revising terms of the North American Free Trade Agreement to protect labor's interests. But perhaps the presence of Bonior, who opposed NAFTA as a representative from suburban Detroit, should put suspicions to rest.

I'm sure Obama will be "interested" in the Rust Belt again in time for the next election.

Monday, November 03, 2008

The Myth of the Spendthrift American

Robert Reich slaps a bad idea across the snout and sends it whence it came:

Post Meltdown Mythologies: Americans Have Been Living Beyond Their Means

The hollowing out of the American middle class had the perverse effect of simultaneously holding down wages and interest rates. Jobs are outsourced to China, driving down demand for American Labor (and thus the price). China sends many of those dollars back to the US (to raise the price of the dollar versus the Yuan) and as a side effect lowering long term rates. For the worker it's rather like being robbed and then offered a low interest loan from your own wallet by the mugger.

Post Meltdown Mythologies: Americans Have Been Living Beyond Their Means

What brought on the economic meltdown of 2008? Besides the bursting of the housing bubble, Wall Street's malfeasance and non-feasance, and Washington's massive failure to oversee Wall Street, fingers are also being pointed at average Americans. Some of them took on mortgages they couldn't afford, of course, but we're also hearing a more basic theme that goes something like this: For too long, Americans have been living beyond our means. We went too deeply into debt. And now we're paying the inevitable price.

.....But this story leaves out one very important fact. Since the year 2000, median family income has been dropping, adjusted for inflation. One of the main reasons the typical family has taken on more debt has been to maintain its living standards in the face of these declining real incomes.

.....The "living beyond our means" argument suggests that the answer over the long term is for American families to become more responsible and not spend more than they earn. Well, that may be necessary but it's hardly sufficient.

The real answer over the long term is to restore middle-class earnings so families don't have to go deep into debt to maintain what was a middle-class standard of living. And that requires, among other things, affordable health insurance, tax credits for college tuition, good schools, and an energy policy that's less dependent on oil, the price of which is going to continue to rise as demand soars in China, India, and elsewhere.

In other words, the way to make sure Americans don't live beyond their means is to give them back the means.

The hollowing out of the American middle class had the perverse effect of simultaneously holding down wages and interest rates. Jobs are outsourced to China, driving down demand for American Labor (and thus the price). China sends many of those dollars back to the US (to raise the price of the dollar versus the Yuan) and as a side effect lowering long term rates. For the worker it's rather like being robbed and then offered a low interest loan from your own wallet by the mugger.

Sunday, October 19, 2008

Blame America First (it's bipartisan!)

The creatures outside looked from pig to man, and from man to pig, and from pig to man again; but already it was impossible to say which was which.

One of the recurrent Republican lines about Democrats is that they are America haters in favor of unilateral disarmament. The logic goes, supposedly, that if America were to disarm other nations would feel less threatened and would spend less on their militaries and we all could devote more spending our domestic economies.

But if you think about it, the standard libertarian Republican holds the same basic belief translated to the economic realm. Pretty universally, they claim Government (the people we elect) is the problem. Never mind that if you elect them these same Republicans would be by definition "part of the problem" and no longer "part of the solution". When it comes to trade, the idea is that if we dropped all of our trade barriers that we would be better off. Remarkably enough American workers cannot compete with subsidized foreign competition.

An Army is not that different from a manufacturing business. Chuck Norris movies to the contrary, militaries primarily consist of taking a large number of people and investing in training and equipment with the hope that the operation can outcompete rivals. The American military swept Iraq from Kuwait and later swept into Iraq without much difficulty because of the massive capital investments of the preceding decades. It wasn't that the Iraqi soldiers were especially cowardly, lazy or stupid, it was that they could not compete with the much more subsidized American competition.

Many countries competing with us for jobs hold down the real wages of their workers by Union suppression or currency manipulation and do not regulate pollution or workplace safety. Developed and Developing Nations are paying companies to build facilities in their jurisdiction. American workers are not especially lazy or stupid but they cannot compete with the much more subsidized foreign competition.

One of the recurrent Republican lines about Democrats is that they are America haters in favor of unilateral disarmament. The logic goes, supposedly, that if America were to disarm other nations would feel less threatened and would spend less on their militaries and we all could devote more spending our domestic economies.

But if you think about it, the standard libertarian Republican holds the same basic belief translated to the economic realm. Pretty universally, they claim Government (the people we elect) is the problem. Never mind that if you elect them these same Republicans would be by definition "part of the problem" and no longer "part of the solution". When it comes to trade, the idea is that if we dropped all of our trade barriers that we would be better off. Remarkably enough American workers cannot compete with subsidized foreign competition.

An Army is not that different from a manufacturing business. Chuck Norris movies to the contrary, militaries primarily consist of taking a large number of people and investing in training and equipment with the hope that the operation can outcompete rivals. The American military swept Iraq from Kuwait and later swept into Iraq without much difficulty because of the massive capital investments of the preceding decades. It wasn't that the Iraqi soldiers were especially cowardly, lazy or stupid, it was that they could not compete with the much more subsidized American competition.

Many countries competing with us for jobs hold down the real wages of their workers by Union suppression or currency manipulation and do not regulate pollution or workplace safety. Developed and Developing Nations are paying companies to build facilities in their jurisdiction. American workers are not especially lazy or stupid but they cannot compete with the much more subsidized foreign competition.

The hits keep on coming

Today's Trucking: Yup, carbon the next truck 'pollutant' targeted

Caterpillar has already announced it's leaving the US on highway engine market thanks in large part to the 2010 rules. Daimler has announced an end to the Sterling line (and the firing of 4500 workers) in March of 2009 thanks in part to the upcoming rules and the aftermath of the 2006 prebuy (though given Daimler's history it seems possible that this move was in part in retaliation for the 2006 strike in the Sterling plant in St Thomas, ON).

Now in the midst of this, the EPA has another wonderful plan to reduce choice and increase cost. We were emitting less carbon (i.e. burning less fuel) before the EPA killed fuel economy with the last rule changes (and the trucks cost $20K less). now the EPA will work hard to make sure we can pay even more and maybe get the economy we had before.

Caterpillar has already announced it's leaving the US on highway engine market thanks in large part to the 2010 rules. Daimler has announced an end to the Sterling line (and the firing of 4500 workers) in March of 2009 thanks in part to the upcoming rules and the aftermath of the 2006 prebuy (though given Daimler's history it seems possible that this move was in part in retaliation for the 2006 strike in the Sterling plant in St Thomas, ON).

Now in the midst of this, the EPA has another wonderful plan to reduce choice and increase cost. We were emitting less carbon (i.e. burning less fuel) before the EPA killed fuel economy with the last rule changes (and the trucks cost $20K less). now the EPA will work hard to make sure we can pay even more and maybe get the economy we had before.

Sunday, September 14, 2008

Come Home America

Fortune: Made (again) in America

I suspect that a lot of the low end manufacturing that was done in China will wind up in Latin America. America will benefit where we have an existing base of facilities and talent. China likely will still be a force in high tech goods and other items that are labor intensive and have a high value to weight ratio. Going the other way, I wonder what the impacts of high transportation costs on U.S. agricultural exports will be?

When the various free trade agreements were inked, the line was that Americans would be moving out of low value manufacturing and into high value Information Technology jobs. Rising energy costs are having a much bigger impact on moving physical goods than on moving data. Perhaps Paul Krugman was right.

Talk of a reverse migration of manufacturing from China to the U.S. has been buzzing across union halls and factory floors, corporate boardrooms and Wall Street.

The cost of shipping outsourced goods from China to U.S. customers has doubled in just two years thanks to high oil prices, and labor costs in China are rising sharply.

I suspect that a lot of the low end manufacturing that was done in China will wind up in Latin America. America will benefit where we have an existing base of facilities and talent. China likely will still be a force in high tech goods and other items that are labor intensive and have a high value to weight ratio. Going the other way, I wonder what the impacts of high transportation costs on U.S. agricultural exports will be?

When the various free trade agreements were inked, the line was that Americans would be moving out of low value manufacturing and into high value Information Technology jobs. Rising energy costs are having a much bigger impact on moving physical goods than on moving data. Perhaps Paul Krugman was right.

Sunday, September 07, 2008

A Building Legal Storm

Attorney general Brown sues 2 port trucking firms over labor practices

Fed Ex Ground has been sued successfully on this basis in multiple jurisdictions. I suspect the California AG is hoping to establish a precedent for truckload carriers (which would be huge). In addition to the state potentially collecting millions in back taxes from trucking firms in the state, it would open the door for Port truckers to organize for better wages, something they are unable to do as "independent contractors".

This may also be a means to preempt the American Trucking Association's challenge to the Ports of Los Angeles' and Long Beach's plans to require all drayage operators to use employee drivers. Most of the current drayage fleets will not survive settling up with the State for back taxes.

The precedents are working their way through the industry. I suspect the first National Truckload carrier targeted will have a lease-purchase/captive finance program, pay a flat rate per mile, and have forced dispatch. Each of those makes the driver a bit more like an employee (with, as one wag put it, a 100 thousand dollar lunchbox).

Rapidly rising costs and the soft freight market are going to change the lease purchase business model rapidly. I expect the looming legal fights will just accelerate the process. Many "independent contractors" are in multi year leases/loans for traditional square nosed tractors which are now uneconomical to operate and are losing value rapidly (much like the used SUV market is imploding). Pre-buying new trucks to avoid 2008 emissions rules, the collapse of construction (a common 2nd home for the traditional design trucks),and marginal operations exiting the business have loaded up the used truck lots. Exports of used trucks will help, but it is going to take time for the market to clear. Tighter credit conditions will also be a drag.

California Atty. Gen. Edmund G. Brown Jr. filed lawsuits against two small trucking companies on Friday on grounds they allegedly deprived drivers of benefits and "cheated the state of California out of thousands of dollars in payroll taxes."

Brown said in a statement that the lawsuits filed in Los Angeles County Superior Court signaled a crackdown on trucking companies at the adjacent ports of Los Angeles and Long Beach that classify drivers as independent contractors to circumvent state employment taxes and labor laws, and have an unfair advantage over competitors

Fed Ex Ground has been sued successfully on this basis in multiple jurisdictions. I suspect the California AG is hoping to establish a precedent for truckload carriers (which would be huge). In addition to the state potentially collecting millions in back taxes from trucking firms in the state, it would open the door for Port truckers to organize for better wages, something they are unable to do as "independent contractors".

This may also be a means to preempt the American Trucking Association's challenge to the Ports of Los Angeles' and Long Beach's plans to require all drayage operators to use employee drivers. Most of the current drayage fleets will not survive settling up with the State for back taxes.

The precedents are working their way through the industry. I suspect the first National Truckload carrier targeted will have a lease-purchase/captive finance program, pay a flat rate per mile, and have forced dispatch. Each of those makes the driver a bit more like an employee (with, as one wag put it, a 100 thousand dollar lunchbox).

Rapidly rising costs and the soft freight market are going to change the lease purchase business model rapidly. I expect the looming legal fights will just accelerate the process. Many "independent contractors" are in multi year leases/loans for traditional square nosed tractors which are now uneconomical to operate and are losing value rapidly (much like the used SUV market is imploding). Pre-buying new trucks to avoid 2008 emissions rules, the collapse of construction (a common 2nd home for the traditional design trucks),and marginal operations exiting the business have loaded up the used truck lots. Exports of used trucks will help, but it is going to take time for the market to clear. Tighter credit conditions will also be a drag.

In an Instant Everything Changed

Guelph Mercury: Anatomy of a car crash

Most truck drivers will be involved in a serious accident eventually. Even if you are not at fault you feel absolutely terrible.

That moment before impact -- the split second when Mary Wybrow lost control -- remains vivid in her memory, even two years later.

"I just remember thinking, 'Oh my God,' and then, 'Bang!' " the 59-year-old retired teacher says, smacking her hands together to emphasize the force.

"Something hit us. Or I hit something."

The collision left Wybrow in hospital for weeks. It destroyed a car and a transport truck, closed Highway 401, sprung a small army of emergency services into action and required a costly cleanup.

For the people in the cars and trucks that crawled by the wreckage west of Cedar Creek Road on Aug. 17, 2006, it was likely just another crash. It wasn't fatal and it got only a small mention in the newspaper.

For the four people involved in the crash -- three in Wybrow's car, one behind the wheel of the truck -- the impact reverberated long after the mangled pieces of Wybrow's Taurus were swept away. There were emergency rooms, traction, surgery, bills to be paid, meals to be made, lost sleep, nightmares. For Wybrow's son, Kemal Koyu, there was a lingering feeling of soaring.

Most truck drivers will be involved in a serious accident eventually. Even if you are not at fault you feel absolutely terrible.

Monday, August 18, 2008

For Want of a Nail

The Telegraph: How a flat tyre took the Caucasus to war

The article goes on to mention that the Georgians were given Satellite photos by the Americans showing the Russians were sending tanks into South Ossetia while the peace talks were occurring. Still, it is amusing to think that the war started from a flat tire. Archduke Ferdinand, Patron Saint of obscure reasons for going to war, would be proud.

Trouble had been brewing in the disputed South Ossetian region for weeks as Moscow-backed militias skirmished with Georgian troops, yet Russian-brokered negotiations between the Georgian government and the separatists had continued.

But the first substantial face-to-face talks on August 7 fell through after a farcical chain of events in which the top Russian diplomat claimed he was unable to attend the meeting in South Ossetia because his car tyre had run flat.

Refusing to take his excuse at face value, the Georgian delegation then assumed they were being lured into a trap, and began the shelling that invited the Russian invasion.

The article goes on to mention that the Georgians were given Satellite photos by the Americans showing the Russians were sending tanks into South Ossetia while the peace talks were occurring. Still, it is amusing to think that the war started from a flat tire. Archduke Ferdinand, Patron Saint of obscure reasons for going to war, would be proud.

Monday, July 21, 2008

CNN does another Hatchet Job on the trucking industry

Medically unfit truckers still on the road, safety study shows

Hundreds of thousands of tractor-trailer and bus drivers in the United States carry commercial driver's licenses, and some of those drivers have suffered seizures, heart attacks or unconscious spells, according to a new U.S. safety study obtained by The Associated Press

There are "hundreds of thousands" of CDL holders and "some of those drivers" have medical problems. Well, how many is some? I'm not sure if this is a poorly written sentence or if the writer is trying to pull a fast one.

According to to the FMCSA there are varying estimates of the number of truck drivers on the road. The CDLIS system, which holds information on current and former CDL holders in all 50 states, has 11.4 million entries. Federal Estimates of the number of people currently working as truck drivers range from 2.9 million to 4.8 million. So there's more than "hundreds of thousands" of CDL drivers out there.

Once again we have a pseudostatistic. We are told medical violations are part of 7.3 million violations, but we are not told how big of a part they are. Are they one percent or twenty percent? "Failing to carry a valid medical certificate" can encompass everything from not having the paper CDL physical on your person (not a big deal) to actually not having a current physical (a big deal). You can't renew your CDL without a current medical certificate so folks without one are not going to be doing that forever. Many states also will void your CDL if they don't have a current cert on file for you (one copy goes to the carrier, one to the State, and one to the driver). Being in possession of a piece of plastic that says "CDL" on the front doesn't necessarily mean that you really have a CDL (just like you can still possess a driver's license even though it is suspended).

Now to the case studies:

A Virginia trucker with a prosthetic leg from a farm accident more than 10 years ago is permitted to drive tanker trucks until at least 2012, even though he doesn't have the proper federal paperwork required for amputees. Virginia revoked the medical license for the official who approved him to drive over charges the official was caught illegally distributing controlled substances.

Well, he's probably going to be driving after that too. The scam is that in order to be certified with a prosthetic you have to demonstrate 2 years of safe operation of a Commercial Motor Vehicle with a prosthetic (which you can't legally do without a valid medical certificate). Shades of M.C. Escher.

George Albright Jr., 61, smashed his 70,000-pound tractor-trailer into congested traffic on Interstate 70 in June 2006, killing four women in a Ford sedan about 30 miles east of Columbia, Mo. Albright's employer agreed earlier this year to pay $18 million in a settlement. A Missouri jury acquitted Albright this month on four counts of second-degree involuntary manslaughter, after his lawyers argued in court that a diabetic episode "put him in an altered state of consciousness." Albright wasn't injured.

If the diabetes is controlled without insulin, he's legal. Obviously if he was indeed having a diabetic episode he wasn't managing his diabetes. The medical examiner under any conceivable system is only going to see the driver every so often. If we are going to allow diabetics to operate CMVs we are going to have to depend on them managing their own condition.

The driver of a 15-passenger "Tippy Toes" day-care bus traveling 63 mph on Interstate 240 in Memphis, Tenn., in April 2002 crashed into a bridge, killing the driver and four of the six children aboard. The National Transportation Safety Board said the driver, Wesley B. Hudson, 27, fell asleep, "quite likely due to an undiagnosed sleep disorder." Investigators said children sometimes had to wake up Hudson, whom the NTSB described as obese and a marijuana user.

A 15 passenger van does not require a CDL. According to the NTSB report Mr Hudson did not have a CDL (PDF, page 5). He had a regular Tennessee license with a "for hire" (taxi) endorsement. Indeed, one of the unimplemented recommendations of the governor's commission that investigated the tragedy was to require child care transport workers to have a CDL. But the AP doesn't let any of this stand in the way of a good story.

The dog that didn't bark in this story is the fact that there are no health requirement for operators of RVs, no matter their weight or size, and that states often allow farms and other intrastate operators of trucks to follow much less rigorous standards.

Also left out is the fact that the CDL physical is nothing more than a basic physical. The doctor making the decision about whether or not to certify the driver only has the driver's answers to the health questionnaire, their direct observation, and a urine test to go on. The physician does not have access to the driver's medical records.

A question of incentives for CDL medical examiners might be raised. The article mentions efforts to avoid "doctor shopping" by drivers, but what about carriers? The physical is paid for by the company, which will usually contract with a doctor to perform the exams. It might seem that a "picky" doctor could be at risk for work being sent elsewhere. I don't know that that is a realistic concern for most of the doctors out there, but there probably are a few conflicted physicians on the margins.

Hundreds of thousands of tractor-trailer and bus drivers in the United States carry commercial driver's licenses, and some of those drivers have suffered seizures, heart attacks or unconscious spells, according to a new U.S. safety study obtained by The Associated Press

There are "hundreds of thousands" of CDL holders and "some of those drivers" have medical problems. Well, how many is some? I'm not sure if this is a poorly written sentence or if the writer is trying to pull a fast one.

According to to the FMCSA there are varying estimates of the number of truck drivers on the road. The CDLIS system, which holds information on current and former CDL holders in all 50 states, has 11.4 million entries. Federal Estimates of the number of people currently working as truck drivers range from 2.9 million to 4.8 million. So there's more than "hundreds of thousands" of CDL drivers out there.

Truckers violating federal medical rules have been caught in every state, according to a review by the AP of 7.3 million commercial driver violations compiled by the Transportation Department in 2006, the latest data available. Texas, Maryland, Georgia, Florida, Indiana, Pennsylvania, Illinois, Michigan, Alabama, New Jersey, Minnesota and Ohio were states where drivers were sanctioned most frequently for breaking medical rules, such as failing to carry a valid medical certificate. Those 12 states accounted for half of all such violations in the United States

Once again we have a pseudostatistic. We are told medical violations are part of 7.3 million violations, but we are not told how big of a part they are. Are they one percent or twenty percent? "Failing to carry a valid medical certificate" can encompass everything from not having the paper CDL physical on your person (not a big deal) to actually not having a current physical (a big deal). You can't renew your CDL without a current medical certificate so folks without one are not going to be doing that forever. Many states also will void your CDL if they don't have a current cert on file for you (one copy goes to the carrier, one to the State, and one to the driver). Being in possession of a piece of plastic that says "CDL" on the front doesn't necessarily mean that you really have a CDL (just like you can still possess a driver's license even though it is suspended).

Now to the case studies:

A Virginia trucker with a prosthetic leg from a farm accident more than 10 years ago is permitted to drive tanker trucks until at least 2012, even though he doesn't have the proper federal paperwork required for amputees. Virginia revoked the medical license for the official who approved him to drive over charges the official was caught illegally distributing controlled substances.

Well, he's probably going to be driving after that too. The scam is that in order to be certified with a prosthetic you have to demonstrate 2 years of safe operation of a Commercial Motor Vehicle with a prosthetic (which you can't legally do without a valid medical certificate). Shades of M.C. Escher.

George Albright Jr., 61, smashed his 70,000-pound tractor-trailer into congested traffic on Interstate 70 in June 2006, killing four women in a Ford sedan about 30 miles east of Columbia, Mo. Albright's employer agreed earlier this year to pay $18 million in a settlement. A Missouri jury acquitted Albright this month on four counts of second-degree involuntary manslaughter, after his lawyers argued in court that a diabetic episode "put him in an altered state of consciousness." Albright wasn't injured.

If the diabetes is controlled without insulin, he's legal. Obviously if he was indeed having a diabetic episode he wasn't managing his diabetes. The medical examiner under any conceivable system is only going to see the driver every so often. If we are going to allow diabetics to operate CMVs we are going to have to depend on them managing their own condition.

The driver of a 15-passenger "Tippy Toes" day-care bus traveling 63 mph on Interstate 240 in Memphis, Tenn., in April 2002 crashed into a bridge, killing the driver and four of the six children aboard. The National Transportation Safety Board said the driver, Wesley B. Hudson, 27, fell asleep, "quite likely due to an undiagnosed sleep disorder." Investigators said children sometimes had to wake up Hudson, whom the NTSB described as obese and a marijuana user.

A 15 passenger van does not require a CDL. According to the NTSB report Mr Hudson did not have a CDL (PDF, page 5). He had a regular Tennessee license with a "for hire" (taxi) endorsement. Indeed, one of the unimplemented recommendations of the governor's commission that investigated the tragedy was to require child care transport workers to have a CDL. But the AP doesn't let any of this stand in the way of a good story.

The dog that didn't bark in this story is the fact that there are no health requirement for operators of RVs, no matter their weight or size, and that states often allow farms and other intrastate operators of trucks to follow much less rigorous standards.

Also left out is the fact that the CDL physical is nothing more than a basic physical. The doctor making the decision about whether or not to certify the driver only has the driver's answers to the health questionnaire, their direct observation, and a urine test to go on. The physician does not have access to the driver's medical records.

A question of incentives for CDL medical examiners might be raised. The article mentions efforts to avoid "doctor shopping" by drivers, but what about carriers? The physical is paid for by the company, which will usually contract with a doctor to perform the exams. It might seem that a "picky" doctor could be at risk for work being sent elsewhere. I don't know that that is a realistic concern for most of the doctors out there, but there probably are a few conflicted physicians on the margins.

Sunday, June 29, 2008

Puzzling

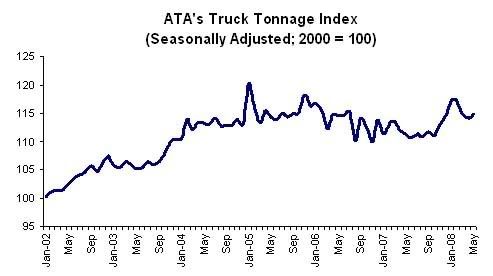

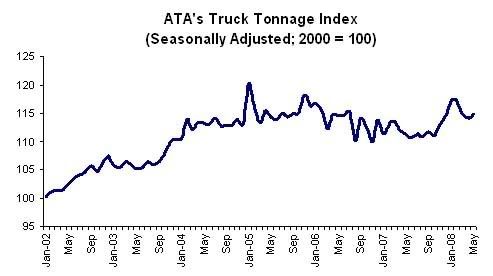

Truck tonnage rises in May

Truck tonnage seems to have been moving in a range with a flat trend the last four years. I am surprised that the decline in automotive and housing related shipments is not having more of an impact (automotive related shipments alone are about 8% of total tonnage). Less than Truckload Carriers have been reporting drops in shipments the past few months, auto production is falling to 16 year lows, housing starts are at 17 year lows, supposedly massive amounts of freight is moving from trucks to trains, but truckload tonnage is back up to where it was in May 2006.

The American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index increased on a month-to-month basis for the first time since January of this year, edging 0.5 percent higher in May. April’s tonnage reading fell a revised 0.6 percent instead of the previously reported 1.1 percent drop.

The seasonally adjusted tonnage index equaled 114.8 (2000 = 100) in May. The not seasonally adjusted index increased 1.1 percent to 118.3 from 117.1 in April.

The seasonally adjusted index was 3.3 percent higher compared with May 2007, marking the seventh consecutive year-over-year increase. In April, the year-over-year gain was 2.2 percent.

ATA Chief Economist Bob Costello said that May’s tonnage reading represents a positive step forward, but noted that freight volumes remain mixed across the industry amid continuously rising fuel prices and a weak economy.

“The fact that tonnage increased on a month-to-month basis for the first time in four months, as well as achieving its largest year-over-year gain since February of this year, is quite positive,” Costello said. “However, year-over-year comparisons continue to reflect the weakness of 2007 rather than robust growth in 2008.”

High diesel fuel prices continue to place a significant burden on motor carriers, he said. “Rising fuel prices are a double-edged sword for the industry,” Costello said. “Since trucks haul virtually all consumer goods at some point in the supply chain, the industry is significantly impacted both directly through high diesel prices and indirectly as consumers have less money to spend on truck-transported goods.”

Truck tonnage seems to have been moving in a range with a flat trend the last four years. I am surprised that the decline in automotive and housing related shipments is not having more of an impact (automotive related shipments alone are about 8% of total tonnage). Less than Truckload Carriers have been reporting drops in shipments the past few months, auto production is falling to 16 year lows, housing starts are at 17 year lows, supposedly massive amounts of freight is moving from trucks to trains, but truckload tonnage is back up to where it was in May 2006.

Sometimes you just wonder

The Bush Administration is blocking new solar projects........

(wait for it)

(wait for it)

....because they're so concerned about the environment they want to do an extended review.

We've got an energy crisis. We've got the money we're sending over to OPEC being passed on to Iraq where it is used to blow up the people and stuff we send to Iraq (talk about funding both sides of a war). I guess "there's a war on" only carries water for the administration when it comes to finding new and creative ways to spy on us.

(wait for it)

(wait for it)

....because they're so concerned about the environment they want to do an extended review.

We've got an energy crisis. We've got the money we're sending over to OPEC being passed on to Iraq where it is used to blow up the people and stuff we send to Iraq (talk about funding both sides of a war). I guess "there's a war on" only carries water for the administration when it comes to finding new and creative ways to spy on us.

Saturday, June 28, 2008

A Price/Asset Deflation Spiral?

In the 1970s inflation in the U.S. reached dizzying levels amidst a falling Dollar, an easy Fed, Soaring Oil Prices, and the infamous "Wage/Price Spiral". Many commentators see the U.S. headed for another inflation catastrophe.

Paul McCulley says this isn't the 70s and that isn't necessarily good news.

In the 1970s many more of the U.S.'s workers were unionized, and unions were negotiating pay increases, not pay cuts.

Today, workers are much less likely to be unionized and lack the pricing power to get wage increases that keep up with increasing food and energy costs. Indeed, workers have been losing ground on real* wages for years. (*real=adjusted for inflation, nominal=the numerical amount, for example a salary of $300/week is the same nominally in 1930 and 2000, but much less in real terms). Workers are going to have to consume less. This is going to limit inflation in food and energy as demand falls for both. That's the good news. The bad news is that this is also going to lower demand for houses, which are already losing value, as well as increase foreclosures. Many people in the "bubble markets" on the coast and in the worst off parts of the rust belt already owe more on their mortgage than their home is worth. This time rising food and energy prices may not show up in rising wages, but rather in falling home prices.

Paul McCulley says this isn't the 70s and that isn't necessarily good news.

But, you retort, if the Fed surrenders to negative real interest rates, it will set off an inflationary spiral, as second and third round effects on prices and wages take hold: capital and labor will extrapolate what should be viewed as a transitorily higher inflation into permanently higher inflation. In a world of perfectly indexed prices and wages, this could well be the case. The 1970s resembled such a world, and nasty oil price shocks that should have been one-off adjustments in the price level via temporarily higher inflation morphed into a price-wage-price inflationary spiral.

In monetary policy terminology, inflation expectations in the 1970s were not firmly anchored at the pre-oil price shock level. This is true, I think, but more elementally, the highly unionized, closed-economy structure of the American economy price and wage setting process was inherently geared to transforming a one-off inflationary shock into an enduring inflationary shock.

We no longer live in such a world. Most importantly, wage inflation is now only loosely connected to price inflation, in the wake of a more globally competitive, less unionized labor force. As Vice Chairman Kohn hinted, the combination of somewhat higher inflation and higher unemployment is a prescription for diminished pricing power by labor, leading to lower real wages (than would be dictated by labor’s productivity growth). Thus, unlike the 1970s, there is little wage fuel to generate over-heating aggregate demand and, thus, a sustained price-wage-price inflationary spiral.

This is good news indeed. Fed officials would make this argument through the lens of well-anchored inflationary expectations, and I have no quarrel with that interpretation, though I think it is but a veil over a more global, more competitive, less oligopolistic price and wage setting structure in the United States. Indeed, I believe the more nasty is the negative terms of trade shock, the fatter is the fat tail of asset price deflation rather than the fat tail of accelerating goods and services inflation.

Deflating asset prices in a highly levered economy are a much more nefarious outcome than temporary increases in inflation in goods and services. This is particularly the case from a starting point of low inflation in goods and services (excluding those involved in the negative terms of trade shock). How so? Simple: a negative terms of trade shock and asset price deflation are a prescription for not just a recession, but a nasty one. More to the point, from a starting point of low goods and services inflation, the Fed is never far from the zero lower limit on nominal short-term interest rates, commonly known as a liquidity trap.

Therefore, the more flexible are wages in the face of a negative terms of trade shock, particularly if it coincides with asset price deflation, the greater is the risk of policy makers losing control of the economy on the downside. In turn, this reality argues for the Fed to tolerate higher headline inflation in the wake of a negative terms of trade shock.

In the 1970s many more of the U.S.'s workers were unionized, and unions were negotiating pay increases, not pay cuts.

Today, workers are much less likely to be unionized and lack the pricing power to get wage increases that keep up with increasing food and energy costs. Indeed, workers have been losing ground on real* wages for years. (*real=adjusted for inflation, nominal=the numerical amount, for example a salary of $300/week is the same nominally in 1930 and 2000, but much less in real terms). Workers are going to have to consume less. This is going to limit inflation in food and energy as demand falls for both. That's the good news. The bad news is that this is also going to lower demand for houses, which are already losing value, as well as increase foreclosures. Many people in the "bubble markets" on the coast and in the worst off parts of the rust belt already owe more on their mortgage than their home is worth. This time rising food and energy prices may not show up in rising wages, but rather in falling home prices.

Tuesday, May 20, 2008

What if the Empire isn't really American?

James K.A. Smith: The Gospel of Freedom, or Another Gospel? Augustinian Reflections on American Foreign Policy

I think Smith is on to something here.

The Empire we live in is in many way one of Corporations and of Culture. When Congressmen talk about taxing Hedge Fund managers at the same rate as mere Businessmen the managers threaten threaten to flee abroad. Corporations hide profits in the most favorable haven. The World certainly doesn't like our politics, but more than that they don't like the lawless irresponsible way of doing business and the kudzu culture that tear through societies everywhere.

Much of the contemporary critique of “empire”—especially from theological quarters—tends to be a hasty, at times naïve, invocation of an epithet to describe America as the world’s bully. Stepping just a couple of rungs above Michael Moore (which doesn’t get one too far up the ladder), this reactionary opposition—to the Bush administration in particular—tends to keep the notion of Empire tethered to the sovereignty of a particular nation-state. But Michael Hardt and Antonio Negri have convincingly suggested in Empire—and more recently, Multitude—that we are dealing with a new mode of Empire that is unhooked from territories and (modern) nation-states, and linked to a network of “flows” of a transnational market. Too much of the theological critique of “American Empire” is reacting as if we lived in an age of (modern) imperialism where sovereign nation-states are the principal actors and where empires are governed from a territorial capital.

But the thrust of Hardt and Negri’s analysis is to show that our age of Empire is post-imperialist; therefore, the nexus of Empire is not linked to or directed by a sovereign state, as the language of “American Empire” would suggest. Rather, Empire is post-national, and therefore any diagnosis and critique of imperial realities must abandon now antiquated imperialist paradigms, including all of the critical apparatus that was marshaled in opposition to such modern accounts of sovereignty. Granted, the United States continues to play a central role in Empire, but not as the territorial seat of imperialist power. There remains a link between America and Empire, but not as a qualifier: not American empire, but rather America serving Empire, even perhaps America as privileged colony of Empire, now understood as a transnational network of “flows” of capital through a global market that transcends territorial control. Post-imperial Empire means that the market has taken on a life of its own as a rather Frankenstein-ish creation of modernity that eludes the control of modern nation-states. Empire has outgrown the constraints of national sovereignty. Its anthem is no longer “Rule, Britannia!” or some other national hymn; its anthem is more on the order of, “I’d like to buy the world a Coke!”

I think Smith is on to something here.

The Empire we live in is in many way one of Corporations and of Culture. When Congressmen talk about taxing Hedge Fund managers at the same rate as mere Businessmen the managers threaten threaten to flee abroad. Corporations hide profits in the most favorable haven. The World certainly doesn't like our politics, but more than that they don't like the lawless irresponsible way of doing business and the kudzu culture that tear through societies everywhere.

Friday, May 16, 2008

Thoughts while listening to podcasts, or Why W ought to be a liberal's favorite letter

I was listening to Ross Douthat's interview of Rick Perlstein, author of Nixonland and I was struck by Douthat's point that for all of Nixon's cynicism and dark plots, his pettiness and veniality made him less dangerous to the Republic than a more competent and emotionally secure cynical politician.

Here's a snip from Douthat's review of Nixonland making the same point

The parallels to our current situation seem striking. I had listened to another Douthat Interview with Ezra Klein earlier in the day, and what I took from Klein was that his concern with the Iraq war is not so much that the war was prosecuted incompetently but that the war was pursued illegitimately (by which he means that the war was not endorsed by a multilateral institution, specifically the UN). I disagree with Klein's belief that a war must be Sanctioned by the UN or some other transnational body in order to be legitimate but leaving that aside, the reason that the liberal side is ascendant in our understanding of the war is that it has gone poorly. The Mexican-American war was recognized by many people in the Army and in the General Population as a really illegitimate and cynical act of aggression but there was no real move to undo the decision, even when war opponent Lincoln gained power. The war had been won quickly and the rewards were tangible enough that the public never renounced the idea.

Had the occupation of Iraq been well planned and run, the question of the propriety of invading Iraq in the first place might never have broken into the national dialogue. Throughout the past few decades, Americans have removed multiple governments by military force. Generally that has happened well before the American public became restive (even if the consequences beyond our attention span were not good). As a result, it became accepted that we could easily take out governments that we disliked and the question of whether we should never got a wide airing. But now, as the war has dragged on, it has become more acceptable across the ideological spectrum to ask whether we should be in the business of regime change. In that way it seems that George W. Bush has performed a National Service.

Here's a snip from Douthat's review of Nixonland making the same point

And yet one doesn’t have to excuse Nixon’s many sins to wonder whether his mix of ruthlessness, self-interest, and low cunning might have been preferable to some of the alternatives on offer. Perlstein depicts a country on the edge of a civil war—a nation in which columnists openly speculated that America might embrace a de Gaulle–style man on horseback, or find a “President Verwoerd” (the architect of South African apartheid) to install in the Oval Office. It was a political moment when the old order could no longer govern, and the new order wasn’t ready. The kids who screamed for Goldwater and McGovern would grow up to be responsible Reagan ites and Clinton ians, but back then they had only idealism, not experience, and Nixonland is an 800-page testament to the dangers of idealism run amok.

......Perlstein sometimes seems to suggest that Nixon was the abyss, and that by choosing him we vanished into it. But this misunderstands contemporary America, and it misunderstands Dick Nixon. A cynic in an age of zeal, a politician without principles at a moment that valued ideological purity above all, he was too small a man to threaten the republic. His corruptions were too petty; his schemes too penny-ante; and his spirit too cowardly, too self-interested, too venal to make him truly dangerous. And he was a bridge, thank God, to better times. Could America have done better? Perhaps. But on the evidence of Nixonland, we could have done far worse as well.

The parallels to our current situation seem striking. I had listened to another Douthat Interview with Ezra Klein earlier in the day, and what I took from Klein was that his concern with the Iraq war is not so much that the war was prosecuted incompetently but that the war was pursued illegitimately (by which he means that the war was not endorsed by a multilateral institution, specifically the UN). I disagree with Klein's belief that a war must be Sanctioned by the UN or some other transnational body in order to be legitimate but leaving that aside, the reason that the liberal side is ascendant in our understanding of the war is that it has gone poorly. The Mexican-American war was recognized by many people in the Army and in the General Population as a really illegitimate and cynical act of aggression but there was no real move to undo the decision, even when war opponent Lincoln gained power. The war had been won quickly and the rewards were tangible enough that the public never renounced the idea.

Had the occupation of Iraq been well planned and run, the question of the propriety of invading Iraq in the first place might never have broken into the national dialogue. Throughout the past few decades, Americans have removed multiple governments by military force. Generally that has happened well before the American public became restive (even if the consequences beyond our attention span were not good). As a result, it became accepted that we could easily take out governments that we disliked and the question of whether we should never got a wide airing. But now, as the war has dragged on, it has become more acceptable across the ideological spectrum to ask whether we should be in the business of regime change. In that way it seems that George W. Bush has performed a National Service.

Sunday, April 13, 2008

"Bitterness"

The present controversy over Barack Obama's comments about the plight of working class people leaves me a little cold. My wife was at one of his events in Indiana, and she reported that there was a standing ovation when Obama gave his little riff on the subject. I heard the riff the next morning on a newscast and I thought it was fine. When I heard there was a controversy about it I went and read the quotes and saw how if you worked at it you could twist this into an anti-God, Guns, and Nativists rant. I think his essential point is sound, people are stressed about the economy and people who are stressed tend to be a bit more disagreeable. I'm religious, I agree intellectually with the basic right to bear arms (though in real life I'm in favor of reasonable restrictions), and I am in favor of a secure border, and I was not bothered by his statement.

I don't think Obama is a believer in the evangelical sense of the word, but I also don't think he's some Muslim manchurian candidate or the antichrist or whatever. He's just a typical agnostic Ivy grad going to a liberal church. I don't think he's atypical among our recent leaders (see Bush, George H.W.). I don't think he's exceptionally harmful to the church. Actually, after W. getting a little air between the Church and the Republican party can only be good for the reputation of the church.

I don't think Obama is going to take away all the guns. That's not a fight that's going to advance the Democratic party and right now the Democrats want more than anything else to be in power. The NRA won't get to it's goal of an AK-47 under every pillow.

On Immigration I expect something not far from what El Presidente Bush (and McCain) really wanted. It's going to happen no matter which one we vote for. To Obama's point, immigration would be a lot easier to deal with if joblessness had not been on the increase for the last 30+ years.

If we fix the economy and get a healthy dose of regulation to keep it fixed, Obama will have been a success.

I don't think Obama is a believer in the evangelical sense of the word, but I also don't think he's some Muslim manchurian candidate or the antichrist or whatever. He's just a typical agnostic Ivy grad going to a liberal church. I don't think he's atypical among our recent leaders (see Bush, George H.W.). I don't think he's exceptionally harmful to the church. Actually, after W. getting a little air between the Church and the Republican party can only be good for the reputation of the church.

I don't think Obama is going to take away all the guns. That's not a fight that's going to advance the Democratic party and right now the Democrats want more than anything else to be in power. The NRA won't get to it's goal of an AK-47 under every pillow.

On Immigration I expect something not far from what El Presidente Bush (and McCain) really wanted. It's going to happen no matter which one we vote for. To Obama's point, immigration would be a lot easier to deal with if joblessness had not been on the increase for the last 30+ years.

If we fix the economy and get a healthy dose of regulation to keep it fixed, Obama will have been a success.

Sunday, March 30, 2008

A Short Guide to How the Bush Administration Reacts to Crisis

The New York Times (via Naked Capitalism ) comments on Paulson's financial industry "regulation" proposal:

Basically they are continuing the pattern of proposing something they wanted to do anyway as the answer to the crisis of the day (see "Bush Tax Cuts", "Bush Tax Cuts II: Grandchild's Woe", and "Rambo IV: Operation Iraqi Freedom"). Style points as well for spinning "non-regulation" as "regulation" and for scrupulous avoidance of effectiveness.

While the plan could expose Wall Street investment banks and hedge funds to greater scrutiny, it carefully avoids a call for tighter regulation.

The plan would not rein in practices that have been linked to the housing and mortgage crisis, like packaging risky subprime mortgages into securities carrying the highest ratings.

......The bulk of the proposal, however, was developed before soaring mortgage defaults set off a much broader credit crisis, and most of the proposals are geared to streamlining regulation.

Basically they are continuing the pattern of proposing something they wanted to do anyway as the answer to the crisis of the day (see "Bush Tax Cuts", "Bush Tax Cuts II: Grandchild's Woe", and "Rambo IV: Operation Iraqi Freedom"). Style points as well for spinning "non-regulation" as "regulation" and for scrupulous avoidance of effectiveness.

Monday, March 24, 2008

The Coming Big Story

Paul Krugman:Taming the Beast

Mark Thoma lays out a pretty decent summary of the change in tax laws and financial regulations that brought us to where we are today (though I noticed Bill Clinton's role in repealing Glass-Steagal was not mentioned). Basically massive tax cuts for the wealthy created a wave of new money, which financial deregulation allowed to flow into new ungoverned instruments.

Pretty soon the new money was finding its way into all sorts of formerly sleepy sectors of markets chasing the next hot thing and pretty reliably creating progressively larger catastrophes. The current catastrophe in the credit markets is large enough to really hurt. Assuming we manage to deal with the crisis successfully, the prudent thing would be to establish rules and regulations to make sure such things don't happen again. Unfortunately, Wall Street has thrown plenty of payola Washington's way which has so far stifled reform. Paradoxically, a larger crisis may be in the national interest because it would change the M.O. for political survival from fund raising and not rocking the boat to making changes before the voters throw the bums out.

America came out of the Great Depression with a pretty effective financial safety net, based on a fundamental quid pro quo: the government stood ready to rescue banks if they got in trouble, but only on the condition that those banks accept regulation of the risks they were allowed to take.

Over time, however, many of the roles traditionally filled by regulated banks were taken over by unregulated institutions — the “shadow banking system,” which relied on complex financial arrangements to bypass those safety regulations.

Now, the shadow banking system is facing the 21st-century equivalent of the wave of bank runs that swept America in the early 1930s. And the government is rushing in to help, with hundreds of billions from the Federal Reserve, and hundreds of billions more from government-sponsored institutions like Fannie Mae, Freddie Mac and the Federal Home Loan Banks.

Given the risks to the economy if the financial system melts down, this rescue mission is justified. But you don’t have to be an economic radical, or even a vocal reformer like Representative Barney Frank, the chairman of the House Financial Services Committee, to see that what’s happening now is the quid without the quo.

Last week Robert Rubin, the former Treasury secretary, declared that Mr. Frank is right about the need for expanded regulation. Mr. Rubin put it clearly: If Wall Street companies can count on being rescued like banks, then they need to be regulated like banks.

Mark Thoma lays out a pretty decent summary of the change in tax laws and financial regulations that brought us to where we are today (though I noticed Bill Clinton's role in repealing Glass-Steagal was not mentioned). Basically massive tax cuts for the wealthy created a wave of new money, which financial deregulation allowed to flow into new ungoverned instruments.

Pretty soon the new money was finding its way into all sorts of formerly sleepy sectors of markets chasing the next hot thing and pretty reliably creating progressively larger catastrophes. The current catastrophe in the credit markets is large enough to really hurt. Assuming we manage to deal with the crisis successfully, the prudent thing would be to establish rules and regulations to make sure such things don't happen again. Unfortunately, Wall Street has thrown plenty of payola Washington's way which has so far stifled reform. Paradoxically, a larger crisis may be in the national interest because it would change the M.O. for political survival from fund raising and not rocking the boat to making changes before the voters throw the bums out.

Saturday, March 08, 2008

Deja Vu All Over Again

VIa Naked Capitalism I found an interesting post on Robert Reich's blog. He quotes Marriner Eccles, a depression era Federal Reserve governor, on the cause of the great depression:

"...an exceptional expansion of debt outside of the banking system" See Paul McCulley's "Shadow Banking System"

Consumption financed by debt, well with negative savings rates I'd say we're there.

Roaring 20s inequality, we've got it .

Strapped Consumers who can't go anymore, check

As mass production has to be accompanied by mass consumption, mass consumption, in turn, implies a distribution of wealth -- not of existing wealth, but of wealth as it is currently produced -- to provide men with buying power equal to the amount of goods and services offered by the nation s economic machinery. Instead of achieving that kind of distribution, a giant suction pump had by 1929-30 drawn into a few hands an increasing portion of currently produced wealth. This served them as capital accumulations. But by taking purchasing power out of the hands of mass consumers, the savers denied to themselves the kind of effective demand for their products that would justify a reinvestment of their capital accumulations in new plants. In consequence, as in a poker game where the chips were concentrated in fewer and fewer hands, the other fellows could stay in the game only by borrowing. When their credit ran out, the game stopped.

That is what happened to us in the twenties. We sustained high levels of employment in that period with the aid of an exceptional expansion of debt outside of the banking system. This debt was provided by the large growth of business savings as well as savings by individuals, particularly in the upper-income groups where taxes were relatively low. Private debt outside of the banking system increased about fifty per cent. This debt, which was at high interest rates, largely took the form of mortgage debt on housing, office, and hotel structures, consumer installment debt, brokers' loans, and foreign debt. The stimulation to spending by debt-creation of this sort was short-lived and could not be counted on to sustain high levels of employment for long periods of time. Had there been a better distribution of the current income from the national product -- in other words, had there been less savings by business and the higher-income groups and more income in the lower groups -- we should have had far greater stability in our economy. Had the six billion dollars, for instance, that were loaned by corporations and wealthy individuals for stock-market speculation been distributed to the public as lower prices or higher wages and with less profits to the corporations and the well-to-do, it would have prevented or greatly moderated the economic collapse that began at the end of 1929.

The time came when there were no more poker chips to be loaned on credit. Debtors thereupon were forced to curtail their consumption in an effort to create a margin that could be applied to the reduction of outstanding debts. This naturally reduced the demand for goods of all kinds and brought on what seemed to be overproduction, but was in reality underconsumption when judged in terms of the real world instead of the money world. This, in turn, brought about a fall in prices and employment.

Unemployment further decreased the consumption of goods, which further increased unemployment, thus closing the circle in a continuing decline of prices. Earnings began to disappear, requiring economies of all kinds in the wages, salaries, and time of those employed. And thus again the vicious circle of deflation was closed until one third of the entire working population was unemployed, with our national income reduced by fifty per cent, and with the aggregate debt burden greater than ever before, not in dollars, but measured by current values and income that represented the ability to pay. Fixed charges, such as taxes, railroad and other utility rates, insurance and interest charges, clung close to the 1929 level and required such a portion of the national income to meet them that the amount left for consumption of goods was not sufficient to support the population.

This then, was my reading of what brought on the depression.

"...an exceptional expansion of debt outside of the banking system" See Paul McCulley's "Shadow Banking System"

Consumption financed by debt, well with negative savings rates I'd say we're there.

Roaring 20s inequality, we've got it .

Strapped Consumers who can't go anymore, check

Sunday, February 17, 2008

Loan Sharks

The Wall Street Journal: High-Interest Lenders

Tap Elderly, Disabled

What's sad is these groups use "partner agreements" with banks to skirt the prohibition on creditors receiving direct deposits of Social Security checks. In an administration that was focused on making government work, there'd be a revision of the rules when this came to light and after 6-9 months (allowing for comment periods and so on) the problem would be solved. This administration chooses to actively avoid performing its regulatory duties, hence the subprime debacle and the ongoing Mexican trucks and Hours of Service fiascoes.

Tap Elderly, Disabled

DOTHAN, Ala. -- One recent morning, dozens of elderly and disabled people, some propped on walkers and canes, gathered at Small Loans Inc. Many had borrowed money from Small Loans and turned over their Social Security benefits to pay back the high-interest lender. Now they were waiting for their "allowance" -- their monthly check, minus Small Loans' cut.

The crowd represents the newest twist for a fast-growing industry -- lenders that make high-interest loans, often called "payday" loans, that are secured by upcoming paychecks. Such lenders are increasingly targeting recipients of Social Security and other government benefits, including disability and veteran's benefits. "These people always get paid, rain or shine," says William Harrod, a former manager of payday loan stores in suburban Virginia and Washington, D.C. Government beneficiaries "will always have money, every 30 days."

What's sad is these groups use "partner agreements" with banks to skirt the prohibition on creditors receiving direct deposits of Social Security checks. In an administration that was focused on making government work, there'd be a revision of the rules when this came to light and after 6-9 months (allowing for comment periods and so on) the problem would be solved. This administration chooses to actively avoid performing its regulatory duties, hence the subprime debacle and the ongoing Mexican trucks and Hours of Service fiascoes.

Monday, February 04, 2008

Big Brother is Watching

CNN: FBI wants palm prints, eye scans, tattoo mapping

The never ending expansion of the Surveillance State under Bush is one of his most unfortunate legacies. I never have understood the belief that as long as government isn't helping someone then it's not big government. The same conservatives who carp about the "Nanny State" are the ones pushing for the "Enforcer State" where big government will spare no right, commit any atrocity, do pretty much anything to keep us safe from any threat. There's a reason our founding generation, surrounded by enemies and riven with sedition, insisted on a bill of rights and why in hindsight we have always looked with regret on those moments in our history when we chose to abridge those rights.

The FBI is gearing up to create a massive computer database of people's physical characteristics, all part of an effort the bureau says to better identify criminals and terrorists.

But it's an issue that raises major privacy concerns -- what one civil liberties expert says should concern all Americans.

The bureau is expected to announce in coming days the awarding of a $1 billion, 10-year contract to help create the database that will compile an array of biometric information -- from palm prints to eye scans.

The never ending expansion of the Surveillance State under Bush is one of his most unfortunate legacies. I never have understood the belief that as long as government isn't helping someone then it's not big government. The same conservatives who carp about the "Nanny State" are the ones pushing for the "Enforcer State" where big government will spare no right, commit any atrocity, do pretty much anything to keep us safe from any threat. There's a reason our founding generation, surrounded by enemies and riven with sedition, insisted on a bill of rights and why in hindsight we have always looked with regret on those moments in our history when we chose to abridge those rights.

Sunday, February 03, 2008

Sunday, January 13, 2008

Hillary's Analysis

There was a bit of controversy last week about some comments Hillary Clinton made last week. Hillary said

My reading of this seems to set LBJ over and above JFK in his ability to "get it done" (and implicitly arguing a "competent" candidate (Hillary/LBJ) was more useful than a "change" candidate (JFK/Obama). LBJ was famous for the "treatment" he could deliver in person and for his ability to work legislation through Congress. Still, though I think a significant part of why LBJ was able to "get it done" was the moral authority of the recently slain JFK and the trauma of a stunned nation. Much like after 9/11, the President was able to run the tables on Congress for a time. I think if it had not been for the progressive rhetoric of immediately sainted JFK and of the soon to fall MLK that it would have been much tougher for Johnson to "get it done".

None of this takes away from the fact that LBJ probably showed more political courage than JFK. Kennedy had not gone to the mat for tough legislation in part because he worried about blowing up the Democratic coalition. Johnson bulled it through and did indeed blow up the coalition (being caught in a losing war didn't help). Other than a self inflicted loss in 76 the Republicans were ascendant for the next quarter century.

What is truly sad is that Republicans in the late 1800s abandoned blacks in the south to the tender mercies of the traitors after having expended so much of the nation's blood and treasure to free them and subdue said traitors. U.S. Grant was the last to try and he was finally forced to give up the fight by a recalcitrant Congress and a pro Klan Supreme Court. The Republicans not only lost black voters, they in many ways lost their identity. The whole Civil Rights controversy that roiled the nation in the 1950s and 1960s should have been in large part settled in the 19th Century.

"I would point to the fact that that Dr. King's dream began to be realized when President Johnson passed the Civil Rights Act of 1964, when he was able to get through Congress something that President Kennedy was hopeful to do, the President before had not even tried, but it took a president to get it done. That dream became a reality, the power of that dream became a real in people's lives because we had a president who said we are going to do it, and actually got it accomplished."